Usaa Cellular View Put Restriction

Content

Live oak Lender’s mobile put provider is available for inspections removed on the You.S. creditors. People don’t deposit inspections out of international financial institutions using the services. Customers can be request an increase in the mobile put restriction from the calling Synchrony Financial’s customer support team.

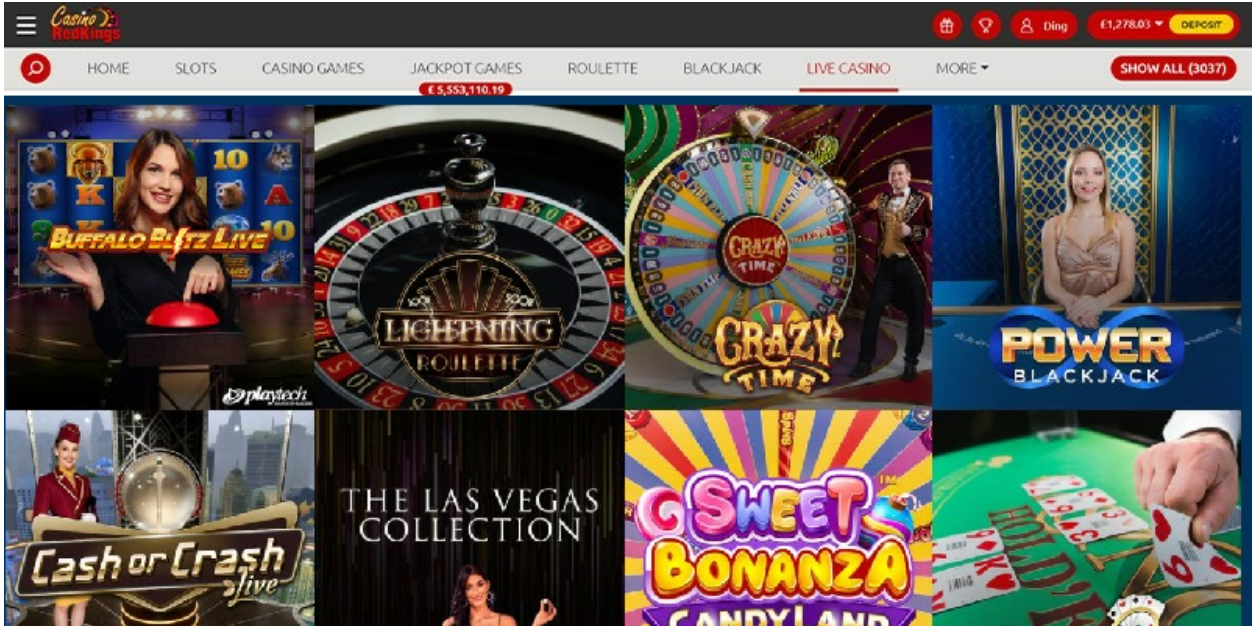

A no-put added bonus is any promo provided by an on-line casino website the fresh put you simply have to manage a merchant account in order to allege they. The realm of gambling on line is continuing to grow rapidly recently, and also the You is no some other. Roulette brings a small members of the family border, low-chance playing alternatives, and higher payment it is possible to. Therefore, web based casinos have a tendency to explore restrictions in order to to enjoy roulette that have an advantage. So as to playing on the roulette doesn’t direct fully so you can betting requirements.

One of several services one SDCCU brings is the ability to deposit dollars from the the ATMs. Although not, you can find limitations about how precisely far dollars you might put during the an enthusiastic SDCCU Atm in a single deal. On this page, we will speak about the fresh SDCCU Atm dollars deposit limit, render certain interesting information about SDCCU, and respond to some common questions about dollars dumps at the SDCCU ATMs. I ranked for each and every institution to your twelve analysis points inside kinds out of APY, limitations and you can restrictions, costs, access, buyers experience and membership minimums. Business account normally have high consider put restrictions compared to individual accounts.

See College student Credit card Decades Restriction

There is absolutely no restrict to help you what kind of cash you will get on your Dollars App account. Although not, there are limits about how far money you can put and withdraw at the same time. To estimate just how much paper currency you could casino playamo reviews potentially put within this a good 7-date several months, simply seem sensible the total amount of report money you’ve got placed before one week. Should your complete amount exceeds $ten,one hundred thousand, you would not be able to put anymore report money before 7-go out months have elapsed. It’s essential to talk with the specific lender otherwise borrowing from the bank relationship and you may regional laws to understand the precise stages in your legislation. That it not only helps you monitor but could be invaluable to possess insurance objectives or if anybody else needs to accessibility the fresh container.

Navy Government Credit Union Import Limit

USAA mobile view deposit is actually a convenient and you may safe means to fix deposit checks without having to go to an actual bank part. Featuring its ample each day and you can monthly put restrictions, as well as the small way to obtain finance, this feature offers higher freedom to possess USAA people. If you have any more questions otherwise run into one issues, USAA’s support service is very easily open to help. Embrace the genuine convenience of cellular banking with USAA making your own economic transactions much easier and you can problem-free.

Yes, you can use the new mobile deposit element during the Vystar Borrowing from the bank Relationship to possess organization monitors. Yet not, you really must be signed up to help you deposit monitors on behalf of the fresh business. When you yourself have questions in regards to the cellular put each day limitation otherwise need help that have and then make in initial deposit, you might get in touch with Vystar Credit Relationship’s customer support team to have let. They will be capable give you more details and tips about utilizing the newest mobile put feature efficiently. Consequently you could potentially deposit as much as $5,100 immediately with the cellular put function. If you attempt to put more than it count, the purchase might possibly be rejected.

- However, for those who deposit dollars at the a non-Chase Atm, the master of the new Atm may charge your a fee.

- The brand new several expansion out of dumps, better known as the put multiplier, is where financial institutions profit of nothing (extremely whether or not).

- Consequently you might put to $1,000 in the dollars at the a good TD Bank Automatic teller machine in a single day.

- Inside digital ages, benefits is key regarding managing your bank account.

- With its big each day and you can monthly deposit limitations, and the brief way to obtain financing, this feature now offers higher independency to have USAA participants.

But not, each other customers must show up or give consent through to the deposit might be processed. Zero, you can’t put a for over their Pursue Cellular Put Limitation. If you attempt to put a check one exceeds the limit, the transaction might possibly be declined. When you have forex trading to put, you will need to change it from the a currency exchange services otherwise lender. OnPoint ATMs accept individual, business, and you will government inspections to possess put.

What’s the Highest Credit limit To have Merrick Financial

– USAA cellular consider put can be found of all cell phones and you will pills, regardless of the systems. Monitors removed to the a foreign financial is almost certainly not recognized to own deposit using Citi Mobile Take a look at Deposit. Merely checks drawn to the You banks are eligible to possess put using this particular service. Checks payable in order to anyone else might not be acknowledged for deposit using Citi Cellular View Deposit. Just monitors made payable to the account proprietor can be deposited with this particular services.

– Sure, you can deposit checks to your a shared membership using the cellular deposit function. Even although you is within your consider put restriction, TD Financial could possibly get set a hang on the fund. This really is a familiar behavior you to banking institutions used to stop deceptive pastime and ensure that the take a look at clears. The size of the new hold may differ with respect to the count and kind from take a look at deposited. – The absolute most you can deposit within the checks during the a good Huntington Lender Automatic teller machine may vary according to the kind of account you have.

Knowing the constraints and you can assistance for the ability is important so you can be sure a soft and you will trouble-totally free put techniques. Following the principles available with Pursue and you will staying in the specified limitations, people can take advantage of the key benefits of cellular banking easily and convenience. The fresh daily restrict to possess on the internet look at dumps may vary based on the type of account you have with BMO Harris. Such, business profile could have a higher every day restrict than simply individual account. Though you can be’t enter a part since this is an internet-simply bank, Bask Bank users get access to both email and you may cellular telephone service.

Pursue Bank doesn’t ensure it is consumers to help you deposit monitors that will be produced out over someone else using the cellular deposit element. Chase Bank doesn’t always have a specific restrict for the matter out of inspections you might put utilizing the cellular put feature. Yet not, understand that the fresh every day and month-to-month constraints to have put numbers however use.

Existiert dies as part of Mr Bet jedoch alternative Boni? Willkommensbonus je neue Zocker Um Vernehmen dahinter schnappen unter anderem Schwierigkeiten nach lockern, kontakten Die leser welches Kundendienst-Gruppe des Verbunden-Spielcasinos. Mr…

Existiert dies as part of Mr Bet jedoch alternative Boni? Willkommensbonus je neue Zocker Um Vernehmen dahinter schnappen unter anderem Schwierigkeiten nach lockern, kontakten Die leser welches Kundendienst-Gruppe des Verbunden-Spielcasinos. Mr…